|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

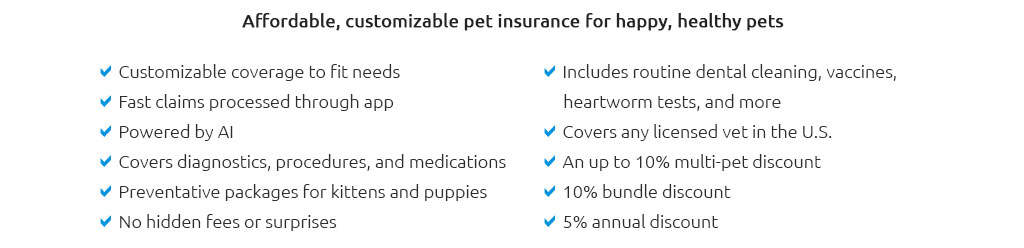

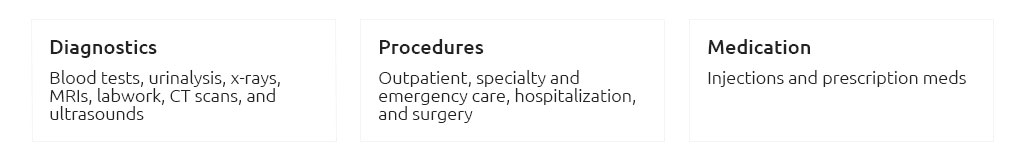

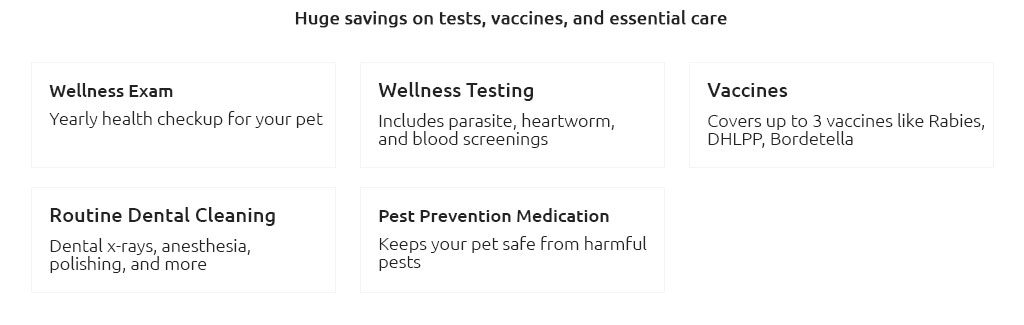

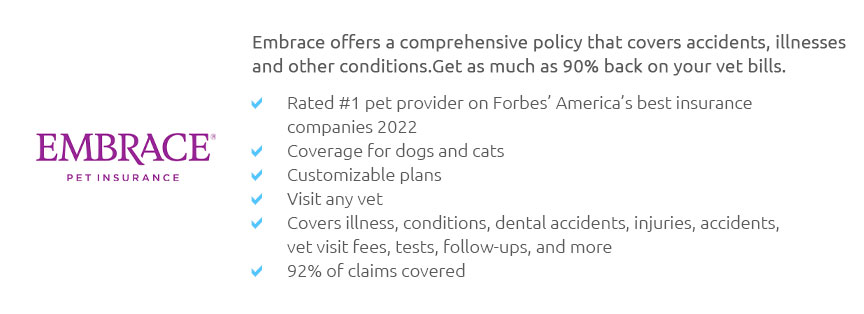

Understanding Low Cost Lifetime Pet Insurance: A Comprehensive GuideIn a world where our pets are not just animals but cherished family members, ensuring their health and well-being is paramount. One of the ways to secure this is through pet insurance, specifically low cost lifetime pet insurance. This type of insurance offers a practical solution for pet owners seeking financial peace of mind without breaking the bank. But what exactly is low cost lifetime pet insurance, and how can it benefit you and your furry friend? At its core, low cost lifetime pet insurance provides a coverage plan that renews annually, offering a set amount of money each year to cover vet bills and medical expenses for chronic and recurring conditions. Unlike time-limited or maximum benefit policies, lifetime insurance ensures that you won’t run out of coverage for a condition over the life of your pet. This feature is particularly valuable for pets prone to hereditary diseases or long-term health issues. Finding the right policy involves considering several factors. First, assess your pet’s current health status, age, and breed, as these elements heavily influence the type and cost of insurance you might need. Many insurers offer customizable plans, allowing you to tailor the coverage based on your pet’s specific needs and your budget. This flexibility can make it easier to find a plan that offers comprehensive coverage at a cost that suits you. Moreover, while the term 'low cost' might suggest compromised quality, this is not necessarily the case. Many reputable insurance companies provide affordable plans by optimizing their coverage options and streamlining administrative processes, passing the savings onto the consumer. It’s crucial, however, to read the fine print. Some low cost policies may have higher excess fees or stricter limitations on certain treatments or conditions. In addition to covering medical expenses, some plans offer extra perks like behavioral therapy, dental treatments, and alternative therapies, which can be significant for pet owners who prioritize holistic health approaches. Thus, when evaluating policies, it’s beneficial to consider these additional features alongside standard coverage. Another critical aspect is the insurer’s reputation for customer service and claim processing. A lower premium might be attractive, but if the company is notorious for slow claim settlements or poor customer service, it might not be worth the savings. Researching customer reviews and ratings can provide insights into an insurer's reliability and responsiveness. Furthermore, the aspect of financial planning cannot be ignored. Low cost lifetime pet insurance allows pet owners to budget effectively, spreading the cost of veterinary care over time rather than facing unexpected hefty bills. This financial predictability can alleviate stress and ensure that money does not become a barrier to providing your pet with the best possible care. Ultimately, the choice of insurance is a personal decision that depends on various factors, including your financial situation, your pet’s health, and your personal preferences. While low cost lifetime pet insurance offers a viable option for many, it’s important to conduct thorough research and consider consulting with a financial advisor or veterinarian to understand the nuances of different policies. Frequently Asked QuestionsWhat is the main advantage of low cost lifetime pet insurance?The primary advantage is continuous coverage for chronic conditions, ensuring your pet is protected throughout its life without the risk of losing coverage after reaching a financial limit on a specific condition. How do I choose the right insurance policy for my pet?Consider your pet’s health, breed, age, and your budget. Look for customizable plans and compare coverage options, exclusions, and customer service reviews to find a policy that best meets your needs. Are there any hidden costs associated with low cost lifetime pet insurance?Some policies may have higher excess fees or limitations on certain treatments, so it’s essential to read the policy details carefully to understand all potential costs. Can low cost insurance cover alternative therapies?Yes, many insurance plans offer coverage for alternative therapies like acupuncture and chiropractic treatments, but it’s important to verify this with the insurer as it varies by policy. Is low cost lifetime pet insurance worth it for older pets?While premiums might be higher for older pets, the continuous coverage for age-related health issues can be highly beneficial, making it a worthwhile consideration depending on your pet’s health and needs. https://www.petsure.com/pet-insurance

Find the best pet insurance policy for your pet. Lifetime cover up to 15k vet fees. No upper age limit. Cover for pre-existing conditions. https://spotpet.com/blog/why-pet-insurance/low-cost-pet-insurance-options

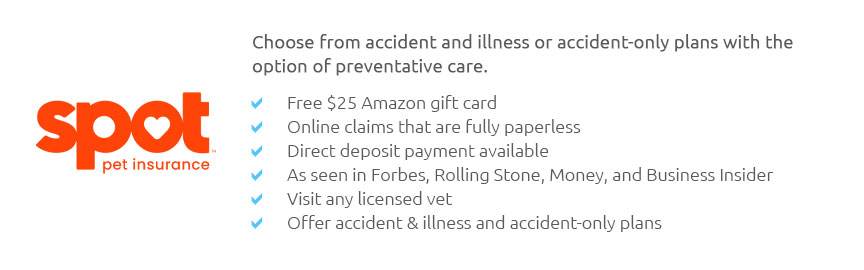

Discounts: Spot Pet Insurance offers a 10% multi-pet discount on all additional pets to help pet parents with more than one pet. No Lifetime ... https://www.nerdwallet.com/p/best/insurance/pet-insurance-companies

Among our top-rated companies, Pets Best offered some of the most affordable rates for dog insurance across a variety of U.S. cities. With ...

|